RV Insurance In Florida: Your Step-By-Step Guide

Navigating the scenic byways of the Sunshine State, it didn’t take me long to understand how vital having the right RV insurance in Florida is for every kind of adventurer.

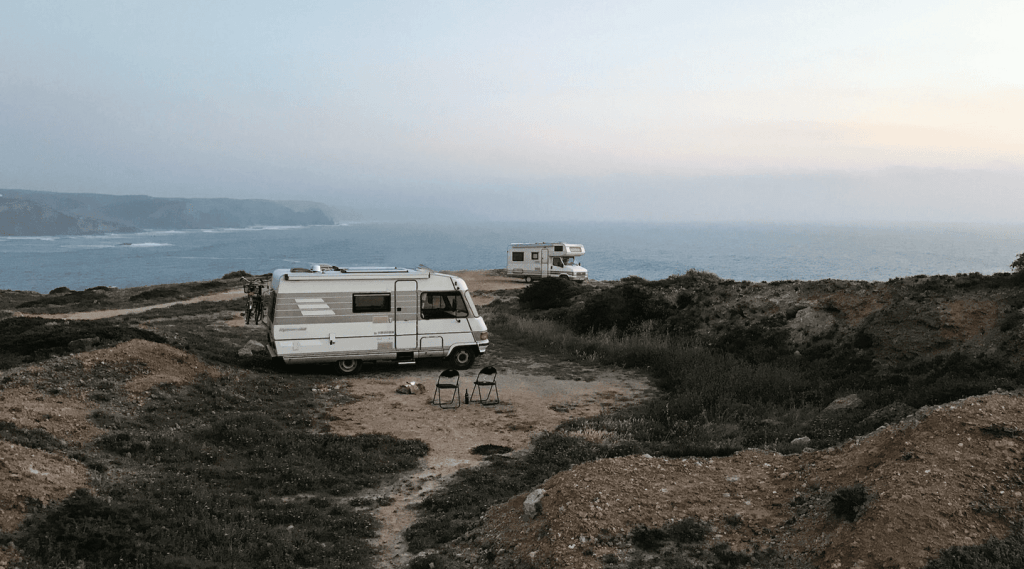

Exploring the diverse terrains of Florida in an RV is a dream for many people who call the state home — from its sun-kissed beaches and verdant forests to its vibrant cities teeming with culture and life. However, securing the right RV insurance in Florida is a pivotal step in the journey, acting as a safety net and providing peace of mind as you traverse through the myriad of experiences Florida has to offer.

Luckily for you, I’ve compiled the most comprehensive step-by-step guide to understanding the various facets of RV insurance in Florida, helping you to make informed decisions that align with your travel needs and budget.

From understanding policy options to knowing the legal requirements, this guide aims to navigate you through the intricacies of RV insurance in Florida, letting you focus on the joy of exploration and discovery in this diverse and beautiful state.

Understand Your RV’s Value

Understanding your RV’s value is paramount when seeking to procure RV insurance in Florida. Determining the current market value is pivotal and may necessitate a professional appraisal or valuation to ensure accuracy in assessment.

Grasping the precise value is integral to obtaining an insurance policy that accurately reflects your RV’s worth, preventing overinsurance or underinsurance and allowing for the most beneficial coverage as you explore the beauty and diversity of Florida, thus ensuring peace of mind and financial prudence in your RV adventures.

Determine Your RV Insurance Needs

Identifying your specific needs is a fundamental step in securing appropriate RV insurance in Florida. A thorough evaluation of your RV’s value, size, and how you intend to use it is essential. Having an accurate idea of the current market value, possibly through an appraisal or valuation, is crucial.

This process aids in discerning the array of coverage options, including liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist, that would best suit your RVing lifestyle in Florida. An informed approach to your RV’s insurance needs ensures a harmonious balance between adequate protection and financial feasibility, enabling a worry-free exploration of the Sunshine State.

Research Insurance Providers

Choosing the right provider is crucial when seeking RV insurance in Florida. This involves extensive research, utilizing online resources, soliciting recommendations, or interacting with local insurance agents to identify reputable insurance companies. Finding a credible provider offering RV insurance in Florida ensures that you receive a policy that aligns well with your needs and preferences.

It’s essential to compare quotes, scrutinize coverage options, and assess customer service reputation to make an informed decision. By meticulously selecting a provider, you secure peace of mind, knowing that your RV adventures in Florida are well-protected, allowing you to fully immerse in the beauty and diversity of the state.

Compare Quotes

Securing the most beneficial RV insurance in Florida requires a careful comparison of quotes from various providers. Gathering multiple quotes allows you to scrutinize premiums, coverage options, deductibles, and available discounts meticulously. This comparison is vital to understand the nuances of each offer fully, ensuring that you select the policy that offers the most comprehensive coverage at the best value.

By considering factors such as coverage limits and deductibles, you can tailor your RV insurance in Florida to your specific needs and budget, allowing you to enjoy your travels across the vibrant landscapes of Florida with confidence and peace of mind.

Review State Requirements

When procuring RV insurance in Florida, a clear understanding of the state’s insurance requirements is indispensable. Florida mandates drivers to maintain minimum levels of bodily injury liability and property damage liability coverage. Familiarizing yourself with these prerequisites enables compliance with legal standards and informs your decision on additional coverage options.

A nuanced grasp of state-imposed mandates ensures that your RV insurance in Florida aligns with legal norms while catering to your individual protection needs. By staying informed about Florida’s specific insurance stipulations, you not only adhere to the law but also optimize your coverage to secure a hassle-free and enriching RVing experience in the state.

Assess Additional Coverage Needs

Navigating through your RV insurance in Florida necessitates considering potential additional coverage needs. Depending on your unique circumstances and RV usage, options like roadside assistance, personal belongings coverage, or full-timer’s coverage may be crucial, especially if you inhabit your RV full-time. Evaluating these supplementary options ensures comprehensive protection, covering diverse aspects beyond standard provisions.

By tailoring your RV insurance in Florida with additional safeguards, you enhance your security and peace of mind while exploring Florida’s picturesque locales. This careful consideration allows you to focus on the joy of the journey, secure in the knowledge that you are well-protected against unforeseen events.

Gather Information

Embarking on obtaining RV insurance in Florida involves preparing a comprehensive set of information. Necessary details include your RV’s make, model, year, vehicle identification number (VIN), and any embedded safety features. Additionally, your personal information, driver’s license details, and driving history are crucial to facilitate the application process.

Having this information readily available expedites the acquisition of RV insurance in Florida, streamlining interactions with potential providers. This meticulous preparation is pivotal in securing an insurance policy that is accurately tailored to your needs, allowing you to traverse Florida’s varied landscapes with assurance and tranquility.

Complete The Application

The final step in securing RV insurance in Florida is completing the insurance application with your chosen provider. It’s vital to be meticulous, accurate, and truthful when filling out the provided application form, as discrepancies can lead to complications or policy invalidation.

This step necessitates a focus on detail and honesty to ensure the acquisition of a policy that genuinely aligns with your needs and circumstances. By meticulously completing your RV insurance application, you pave the way for a seamless and transparent relationship with your insurer, enabling you to embark on your Floridian adventures with confidence and comprehensive protection.

Customize Your Policy

Crafting an apt RV insurance policy involves collaboration with your provider to fine-tune your policy, ensuring it meets your distinct needs. This customization process is where you delve into discussions about coverage limits, deductibles, and any additional endorsements required, shaping the policy to your unique circumstances and preferences.

By having open dialogues with your insurer, you can tailor your RV insurance in Florida to encompass your specific requirements and considerations, granting you the flexibility and assurance to explore the Sunshine State’s myriad of attractions, secure in the knowledge that your coverage is as comprehensive and individualized as possible.

Activating your RV insurance in Florida necessitates paying the initial premium, with payment options typically ranging from monthly to annual installments. Once your payment is processed, you’ll promptly receive proof of insurance, usually an insurance ID card, solidifying the activation of your policy.

It’s imperative to keep this proof readily available in your RV at all times, as it’s essential when dealing with law enforcement or in the event of an accident. By securely maintaining proof of your meticulously crafted RV insurance in Florida, you ensure smooth encounters on the road, allowing you to immerse in your travels with peace and assurance.

FAQs About RV Insurance In Florida

How Much Is RV Insurance In Florida?

The cost of RV insurance in Florida can vary widely, depending on factors like the RV’s make, model, and age, the chosen coverage limits and deductibles, and the owner’s driving history.

On average, you might expect to pay anywhere between $800 and $3,000 per year for RV insurance in Florida. To get the most accurate pricing, it’s advisable to obtain quotes from multiple insurance providers and consider the specific coverage options that suit your needs and budget.

What type of license is required to drive an RV in Florida?

In Florida, a standard driver’s license is sufficient for driving most RVs. However, if the RV has a weight of over 26,000 pounds or is towing a vehicle or trailer over 10,000 pounds, a commercial driver’s license (CDL) may be required.

It’s crucial to verify the licensing requirements specific to your RV’s characteristics to ensure compliance with Florida’s laws while enjoying the flexibility and comfort that RVing brings.

Final Thoughts

Navigating the multifaceted realm of RV insurance in Florida can be intricate, but it’s imperative for securing peace of mind on your journeys. By understanding your RV’s value, researching providers, comparing quotes, and meticulously customizing your policy, you can obtain RV insurance in Florida that aligns seamlessly with your needs and budget. Whether you’re a seasoned RVer or embarking on your inaugural journey, optimizing your insurance ensures you’re poised to relish Florida’s boundless vistas unencumbered.